Are you looking to stay up-to-date with the taxation system and compliance requirements in Indonesia? This article is a comprehensive list of all you need to know about Tax Indonesia, including income tax, tax amnesty and more. Keep reading to learn how to remain compliant with the country’s tax regulations.

Introduction to Tax Indonesia

- Taxation in Indonesia is governed by the Tax Amnesty Law of 2016, with regulations enforced by the Directorate General of Taxation.

- Income tax is the primary source of revenue for the Indonesian government, and taxes are collected at both the central and regional level.

- Individuals and businesses must register for taxation and fulfill their tax obligations to remain compliant.

- Taxpayers in Indonesia can take advantage of the country’s tax amnesty program to reduce their tax burden.

- Understanding and complying with Indonesia’s taxation system can be a daunting task for individuals and businesses; however, the country’s tax amnesty program offers a way to reduce their tax burden.

Income Tax Requirements in Indonesia

Understanding the taxation system in Indonesia can be a daunting task. Here we will outline the various income tax requirements for both local and foreign businesses and individuals in the country.

- Tax Amnesty: The government of Indonesia has introduced a tax amnesty program to encourage businesses and individuals to declare and pay taxes. This program offers reduced penalties and interest for those who declare and pay taxes on income previously not reported.

- Tax Rate: The tax rate for individuals is 5% for residents and 25% for non-residents. For companies, the tax rate is 0% for small businesses with income less than IDR 4.8 billion, and 25% for larger companies.

- Taxable Income: The taxable income for individuals includes wages, salaries, and income from investments. For companies, the taxable income includes profits and other forms of income.

- Tax Returns: All individuals and companies must file annual tax returns by the 30th of April each year. These returns must include a breakdown of income and expenses and any applicable deductions.

- Tax Compliance: All companies and individuals must comply with the Indonesian tax laws and regulations. This includes filing tax returns and paying taxes on time. Failure to comply can result in severe penalties.

By understanding the tax requirements in Indonesia, businesses and individuals can ensure they remain in compliance with the law and avoid hefty penalties. Stay informed on Tax Indonesia and the country’s taxation system to remain compliant and up-to-date.

Tax Amnesty in Indonesia

- Tax amnesty in Indonesia is a program intended to encourage taxpayers to declare their previously undeclared income and assets.

- The program is available for a limited period of time and provides a reduced penalty for those who declare their income and assets.

- The purpose of the program is to increase compliance with the Indonesian taxation system and to ensure that all income is reported and taxed.

- The program applies to both domestic and foreign taxpayers, as well as to individuals and businesses.

- Under the program, taxpayers may be eligible for a reduction in penalties and interest charges if they declare their previously undeclared income.

- Taxpayers may also be eligible for a reduction in the amount of income tax they owe.

- The program is administered by the Indonesian Tax Office and taxpayers must submit a full disclosure of all their income and assets to be eligible for the program.

- Taxpayers must also provide evidence of the source of the income and assets in order to receive the benefits of the program.

- Tax amnesty in Indonesia is an important tool for the government to increase compliance with the taxation system and to ensure that all income is reported and taxed.

Understanding the Taxation System in Indonesia

- Income Tax: Individuals who are resident in Indonesia are liable to pay income tax on their worldwide income, while non-residents are only taxed on their Indonesian-sourced income. The rate of income tax varies depending on the amount of income earned.

- Corporate Tax: Companies in Indonesia are liable to pay corporate income tax at a rate of 25%. This rate is applied to the taxable income of the company.

- Tax Amnesty: The Indonesian government offers a tax amnesty program for businesses and individuals who have not paid their taxes. This program offers reduced penalties for those who comply with the program’s requirements.

- Double Taxation Agreement: Indonesia has signed double taxation agreements with several countries, including Australia, France, Germany, India, and the United Kingdom. These agreements reduce the rate of tax that can be charged on income earned in one of the countries and provide tax relief for companies and individuals doing business in both countries.

Tax compliance in Indonesia can be complex, but understanding the country’s taxation system is essential for businesses and individuals looking to do business in the country. By taking advantage of the tax amnesty program and double taxation agreements, businesses and individuals can ensure they are compliant with the Indonesian taxation system while minimizing the amount of tax they pay.

Compliance Requirements in Indonesia

- Taxpayers must register for a taxpayer identification number (NPWP) and an electronic tax account (e-faktur).

- Taxpayers must file an annual tax return (SPT) and pay any taxes due by the set due date.

- The Indonesian government offers a tax amnesty program to encourage taxpayers to declare unreported assets and income, and submit a tax return.

- Taxpayers must pay all applicable taxes, such as income tax, value-added tax, and excise tax.

- Taxpayers must keep accurate records of their financial activities and submit the records upon request.

- Taxpayers must follow the applicable regulations prescribed by the Directorate General of Taxes.

Understanding Indonesia’s compliance requirements is essential for any taxpayer in the country. By registering for a taxpayer identification number and an electronic tax account, filing an annual tax return, and paying any taxes due, taxpayers can ensure that they are in compliance with the country’s taxation system.

Furthermore, the Indonesian government offers a tax amnesty program to encourage taxpayers to declare unreported income and assets and submit a tax return. Additionally, taxpayers must pay all applicable taxes, such as income tax, value-added tax, and excise tax, as well as keep accurate records of their financial activities and submit the records upon request.

By following the applicable regulations prescribed by the Directorate General of Taxes, taxpayers can ensure tax compliance in Indonesia. With an understanding of the country’s taxation system and compliance requirements, taxpayers can remain compliant and avoid penalties.

Indonesia is a country with a complex yet unique taxation system. We have outlined the key points to understanding the taxation system and compliance requirements of Tax Indonesia. This includes topics such as income tax, tax amnesty, tax incentives and more. By understanding the system, businesses can remain compliant and take advantage of the tax incentives to help their business grow and succeed in the Indonesian market.

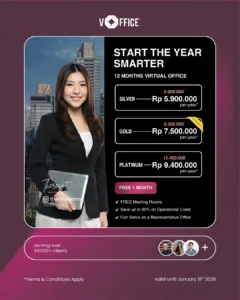

If you are a foreign individual or business looking to set up a tax presence in Indonesia, vOffice Indonesia can help make the process quick and easy. With our team of experienced tax consultants, we can assist you in registering for various tax types, including income tax, value-added tax (VAT), and withholding tax. Our streamlined process ensures that all necessary documentation is completed accurately and efficiently, allowing you to focus on growing your business in Indonesia. Don’t let the complexities of Indonesian taxation hold you back – let vOffice Indonesia handle your tax needs and help you stay compliant with local regulations. Contact us today to learn more.