KBLI virtual offices in Indonesia refer to the official business classification that governs the legality of providing virtual office services under KBLI 82110 – Combined Office Administrative Services Activities. KBLI 82110 serves as the primary legal basis for determining whether a virtual office can be lawfully used as a business domicile, company address, and as supporting documentation for risk-based OSS licensing.

Established by Badan Pusat Statistik (BPS) under KBLI 2020, this classification applies to virtual office providers that offer real administrative services, as well as to businesses, consultants, and freelancers who require a legally compliant business address in accordance with zoning regulations and government policies.

Scope of KBLI 82110

KBLI 82110 does not merely regulate the use of an address. This code covers the provision of real and ongoing office administrative services. These services include guest reception, mail handling, personnel support, and other administrative functions that support business activities.

This is why a virtual office is legally different from merely borrowing an address. Without genuine administrative services, an address cannot be classified as a legally valid virtual office.

Risk Level and Business Licensing

Under the risk-based OSS system, KBLI 82110 is classified as a low-risk business activity. This means virtual office providers only need a Business Identification Number (NIB) to operate legally. However, this convenience does not eliminate other compliance obligations.

Providers must still have a physical location that complies with office or commercial zoning regulations and meet local building and administrative requirements.

Tax Aspects and Latest Regulations

From a taxation perspective, the Directorate General of Taxes (DJP), through the latest regulations, emphasizes that virtual offices may not be used as fictitious addresses. The use of a virtual office must support real business activities, be backed by an active contract, and comply with the rule of one address for one VAT-registered entity (PKP).

For users, this means choosing the right virtual office provider is critical. Selecting a non-compliant provider can directly affect your tax status and the legal standing of your business.

Read Also: VAT Registration (PKP) for Virtual Offices under PER-7/PJ/2025: A Complete Guide for Business Owners

Legal Requirements for a Compliant Virtual Office

To comply with KBLI 82110, a virtual office must meet several key requirements. The location must be within a government-recognized office zoning area. Physical facilities such as meeting rooms or administrative areas must be available. Services must include receptionists, mail management, and other administrative support. All client relationships must be supported by valid written contracts.

If any of these elements are not fulfilled, the business domicile may be rejected by the relevant authorities.

Business Impact of Choosing the Wrong KBLI

Many business owners assume that KBLI selection is merely a formality. In reality, choosing the wrong KBLI for a virtual office can result in VAT deregistration, rejection of subsequent licenses, and reputational risks. In today’s business ecosystem, regulatory compliance is the foundation of trust.

Why KBLI Compliance Matters to You

As a business owner, consultant, or freelancer, your goal is simple: to operate smoothly without legal issues. KBLI compliance for virtual offices is the first step. With the correct classification, you gain certainty of domicile, streamlined licensing, and long-term tax security.

Read Also: How vOffice Virtual Office Supports OSS RBA Applications in Compliance with RDTR 2026

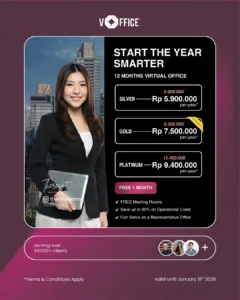

vOffice’s Commitment to KBLI Compliance

As a virtual office service provider, vOffice ensures that all services we manage comply with the applicable KBLI 82110 regulations in Indonesia. The business addresses provided are located in officially designated commercial or office zones and are supported by physical facilities and real administrative services, making them legally valid as company domiciles.

With a structured system, virtual office setup can be completed quickly—often in less than 24 hours—without compromising legal compliance.

In addition to strategic business addresses, vOffice virtual office services include dedicated phone numbers, professional meeting rooms, and support for legal documentation such as deeds of establishment, SKDP, NPWP, SIUP, TDP, and other essential documents.

Operating since 2012, serving over 50,000 clients, ISO 9001 certified, and a recipient of a MURI Record, we deliver virtual office solutions that are not only flexible and efficient but also provide full legal certainty—allowing you to focus on growing your business with confidence.

Below are strategic vOffice location options for virtual offices in Indonesia:

- Rent Virtual Office Jakarta

- Rent Virtual Office Tangerang

- Rent Virtual Office Bekasi

- Rent Virtual Office Surabaya

- Rent Virtual Office Bali

- Rent Virtual Office Medan

- Rent Virtual Office Bandung

- Rent Virtual Office Batam

What are you waiting for? Contact us now and get various attractive offers!

FAQ About KBLI Virtual Offices

Is a virtual office legal in Indonesia?

Yes. A virtual office is legal in Indonesia as long as it uses KBLI 82110 and complies with zoning requirements and provides real administrative services.

Which KBLI is used for virtual offices?

KBLI 82110 – Combined Office Administrative Services Activities.

Can a virtual office be used as a PT domicile?

Yes, provided the virtual office provider complies with KBLI regulations, tax requirements, and local zoning rules.

Is a virtual office considered a high-risk business?

No. KBLI 82110 is classified as a low-risk business activity under the OSS system.

What are the risks of choosing the wrong virtual office provider?

The risks include tax issues, rejection of business licenses, and even cancellation of the company’s legal status.