As a management consultant, understanding your tax obligations is a crucial step in maintaining the legality and stability of your business. Every income earned from consulting services carries specific tax consequences, depending on your business structure and legal status.

At vOffice, we often meet consultants who struggle to manage their tax obligations due to rapid regulatory changes and increasingly digital reporting systems. This guide is designed to help you understand the fundamentals of taxation for management consultants in a clear and comprehensive way.

Read Also: vOffice Tips for Management Consultants Who Want to Succeed

Types of Taxes Applicable to Management Consultants

There are three main types of taxes that management consultants in Indonesia must pay attention to:

- Income Tax Article 21 (PPh 21): Applies to consultants employed as staff. This tax is deducted directly from monthly salaries with progressive rates ranging from 5% to 35%.

- Income Tax Article 23 (PPh 23): Applies to consulting services provided to corporate clients at a rate of 2% of gross income. If you do not have a Tax ID (NPWP), the rate increases to 4%.

- Value Added Tax (VAT/PPN): Applies to Taxable Entrepreneurs (PKP) with a rate of 11%, which will be adjusted to 12% for certain categories starting in 2025.

Understanding these three tax types will help you avoid miscalculations and ensure smooth cash flow management.

Read Also: How to Calculate Income Tax Article 21: Complete Guide with Examples

Business Status and Tax Calculation Methods

If you are an independent consultant, there are two methods of tax calculation you can use:

- Norma of Net Income Calculation (NPPN), applicable to taxpayers with annual revenue below IDR 4.8 billion.

- Full Bookkeeping, used for businesses with higher revenue or for those who prefer clearer and more detailed financial reporting.

For consultants who are also permanent employees, tax calculations must combine income from both sources to prevent double reporting.

Administrative Obligations You Must Fulfill

In addition to tax calculation, several administrative obligations must also be met:

- Tax ID (NPWP) and Integrated NIK: Since 2024, the National ID (NIK) has been used as the new NPWP format.

- PKP Registration: Required for businesses with annual revenue exceeding IDR 4.8 billion. PKP holders must issue e-Invoices and file monthly VAT reports.

- Periodic and Annual Tax Return (SPT) Filing: Conducted through Coretax DJP Online with deadlines on the 20th of each month for Periodic SPT, and March 31 or April 30 for Annual SPT filings.

Read Also: Penalties for Not Paying Taxes in Indonesia

Exemptions, Facilities, and Tax Incentives

Certain expenses can be deducted from gross income, such as:

- Project staff salaries

- Third-party service fees

- Consulting project operational costs

In addition, the government provides a 50% tax rate reduction for corporate taxpayers with annual revenue up to IDR 50 billion. There are also incentives like Tax Allowance and Super Deduction R&D for research and development activities.

Tax Challenges for Management Consultants

Many consultants face taxation challenges such as:

- Late filing of tax returns (SPT) due to a lack of understanding of the DJP digital system.

- Errors in calculating Income Tax Article 23, especially for multi-entity projects.

- Poor bookkeeping, which complicates tax audits.

Additionally, late reporting penalties such as fines up to IDR 1,000,000 and 2% monthly interest often occur due to poor administration. Tax compliance should not only be viewed as an obligation but also as a business strategy to maintain reputation and long-term financial efficiency.

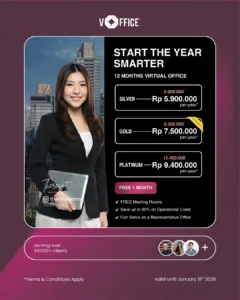

How vOffice Can Help You

If you need assistance with tax planning or reporting for your management consulting business, vOffice’s tax consulting services are ready to help. We ensure that all your tax obligations are properly fulfilled while identifying legal and safe tax-saving opportunities.

Learn more about our services on the vOffice Tax Consulting Services page.

Our team can assist you with all your tax needs, including:

- Accounting services, financial report creation, and tax reporting

- Payroll Management Services

- PKP Registration Services in Jakarta and surrounding areas

Get a FREE consultation now and enjoy special offers

Tax compliance for management consulting businesses requires accuracy, good bookkeeping, and a solid understanding of regulations. By following this guide, you can maintain compliance while improving tax efficiency.

If you need professional assistance, vOffice is ready to manage all your tax obligations safely and efficiently, allowing you to focus on growing your consulting business.

FAQ about Taxation for Management Consulting Businesses

Is management consulting subject to VAT?

Yes. This service is classified as a Taxable Service with an 11% VAT rate, which will increase to 12% starting in 2025.

When must consultants register as PKP?

When their annual business revenue exceeds IDR 4.8 billion.

Are independent consultants required to have a Tax ID (NPWP)?

Yes. Since 2024, the National ID (NIK) has been used as the new NPWP.

What are the risks of late tax filing?

Fines ranging from IDR 100,000 to IDR 1,000,000, depending on the type of tax return.

How can you legally optimize your tax burden?

Utilize deductible expenses, take advantage of tax reduction facilities, and consult a licensed tax advisor.