Creating an advance payment tax invoice in CoreTax must follow the official provisions issued by the Directorate General of Taxes (DJP), including the use of the 11/12 “Other Value” Tax Base (DPP Nilai Lain) and the 12 percent VAT rate. The CoreTax DJP system is automatically integrated, so calculations and the issuance of the 17-digit Tax Invoice Serial Number (NSFP) are processed upon upload.

If you receive payment before delivering goods or services, you are required to issue an advance payment tax invoice using transaction code 04. This requirement is reinforced by the latest regulation, such as PER-11/2025.

CoreTax is designed as an online-based system that replaces the previous e-Faktur Desktop mechanism. This integration simplifies synchronization between advance payment invoices and final settlement invoices.

Preparation Before Creating the Invoice

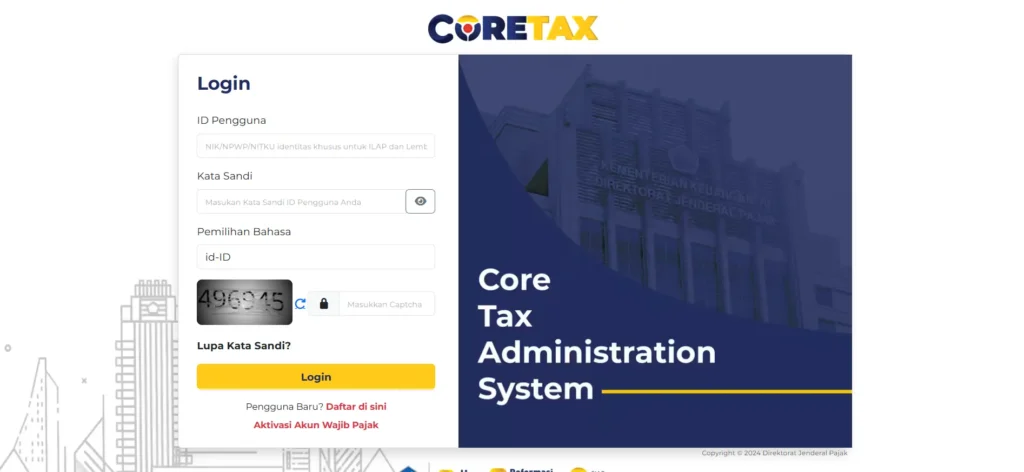

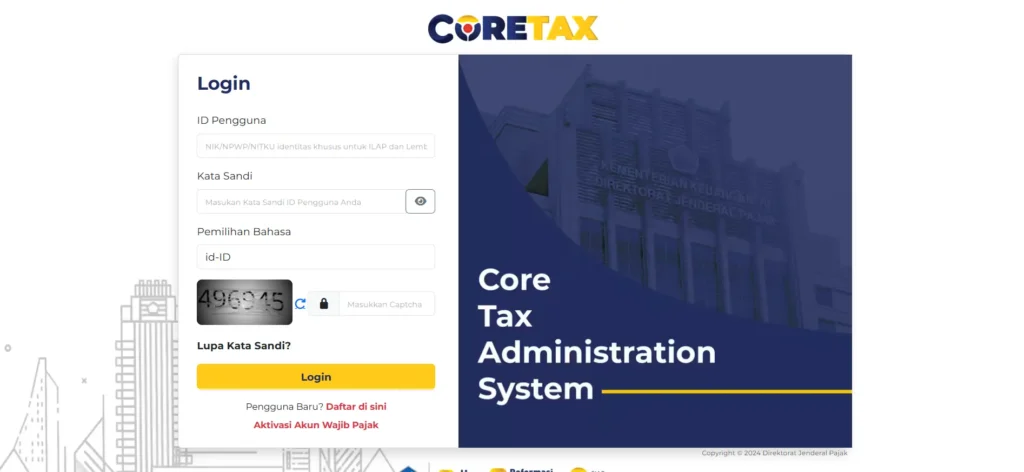

Before accessing the system, make sure you have logged in to CoreTax DJP using a valid Taxpayer Identification Number (NPWP) and electronic certificate.

Check the buyer’s data, including NPWP, name, and address. Ensure that the transaction is subject to VAT and does not fall under the luxury goods category if using the “Other Value” Tax Base scheme.

Prepare the contract details, such as:

- Total contract value

- Advance payment amount received

- Quantity and unit price

- Description of Taxable Goods (BKP) or Taxable Services (JKP)

This step is crucial to avoid errors in calculating the 12 percent VAT.

Also Read: How to Create a Bonded Zone Tax Invoice in CoreTax

Steps to Create the First Advance Payment Tax Invoice

Here is the main procedure:

- Check the “Advance Payment” option in the transaction document section.

- Leave the Invoice Number field blank, as the system will auto-generate it upon upload.

- Use the advance payment receipt date as the Invoice Date.

- Enter the complete contract details in the transaction column.

- Select “DPP Nilai Lain” and enter 11/12 of the contract’s Tax Base.

- In the Advance Payment field, input 11/12 of the advance payment amount received.

- Save as draft or click upload to automatically generate the 17-digit NSFP.

Simple example:

If the contract value is IDR 120 million, then the “Other Value” Tax Base is 11/12 × 120 million = IDR 110 million. VAT is calculated at 12 percent of that Tax Base.

How to Input the Second Installment Advance Payment

For the next advance payment stage:

- Select the “Advance Payment” option again.

- Fill in the Invoice Number with the number from the first advance payment invoice.

- The system will automatically populate the transaction details.

- Enter the full Tax Base value according to the April 2025 update.

- Verify the 12 percent VAT calculation on the remaining Tax Base.

- Upload after validation.

This automatic integration is one of CoreTax’s key advantages compared to e-Faktur Desktop.

Also Read: How to Create a Tax Invoice in CoreTax: Complete 2026 Guide

Differences Between CoreTax and e-Faktur Desktop

Some important differences:

- CoreTax NSFP consists of 17 digits and is automatically generated upon upload.

- e-Faktur Desktop uses 16 digits and requires a request via e-Nofa.

- CoreTax provides an auto-fill feature for subsequent installments.

- Data migration from Desktop is not always automatically synchronized for settlement invoices.

If the advance payment invoice is created in e-Faktur Desktop and the settlement invoice in CoreTax, the system will treat them as separate invoices.

Common Challenges in Creating Advance Payment Invoices

Many taxpayers make mistakes in:

- Calculating the 11/12 “Other Value” Tax Base

- Using the wrong transaction code

- Failing to synchronize with the settlement invoice

- Incorrectly entering the second installment value

These errors may trigger corrections during a tax audit by the Tax Office (KPP).

Therefore, technical understanding is essential to ensure accurate reporting of Monthly VAT Returns (SPT Masa PPN).

Need Help to Avoid Miscalculations?

Creating an advance payment tax invoice in CoreTax is more integrated, but it still requires high accuracy. Even small mistakes can impact tax reporting and potentially result in administrative sanctions.

As a provider of accounting and tax reporting services, we at vOffice help ensure that your entire process is accurate and compliant with the latest DJP regulations. Our tax consultants are ready to assist you from Tax Base calculations and invoice issuance to Monthly VAT Return reporting.

If you want a more efficient tax process with minimal risk, vOffice tax services are the right choice to support your business compliance.

Contact us for a FREE consultation!

FAQ About Advance Payment Tax Invoices

Is every advance payment required to have a tax invoice?

Yes, as long as the transaction involves the delivery of Taxable Goods (BKP) or Taxable Services (JKP) subject to VAT.

Why is the 11/12 Tax Base used?

Because with the 12 percent VAT rate, the calculation uses the 11/12 “Other Value” Tax Base scheme in accordance with the latest tax regulations.

When should the invoice be issued?

The tax invoice must be issued when the advance payment is received or upon delivery of Taxable Goods/Services in accordance with the applicable provisions.

Does the invoice number need to be entered manually?

No. CoreTax automatically generates the tax invoice serial number during the invoice creation or upload process.

Can an uploaded invoice be amended?

Any amendment to an uploaded invoice must follow the correction or replacement invoice mechanism in accordance with the procedures established by the Directorate General of Taxes (DJP).