A consolidated tax invoice (faktur pajak digunggung) is a type of output tax invoice used by retail VAT-registered businesses (PKP) when supplying Taxable Goods or Taxable Services to end consumers without complete buyer identification. This provision is explicitly regulated under Article 13 paragraph (5a) of the VAT Law and is fully accommodated within the Coretax DJP system.

In essence, you are still required to collect and report VAT even if the buyer does not provide an NPWP, name, or complete address. Coretax provides a dedicated mechanism to ensure this obligation is fulfilled in an orderly and compliant manner.

Read Also: How to Create a Tax Invoice in Coretax: A Complete Guide

Characteristics of a Consolidated Tax Invoice

A consolidated tax invoice has different characteristics compared to a standard tax invoice. Buyer identity is simplified, transactions are mass-based, and the creation process is not done through manual, one-by-one input.

In Coretax DJP, consolidated tax invoices can only be created by uploading an XML file. This approach is intended to maintain data consistency, improve input efficiency, and simplify validation by the DJP system.

Preparing the Consolidated Tax Invoice XML Template

The first step is to prepare the official Excel template provided by the Directorate General of Taxes (DJP). The template and the Excel-to-XML converter can be downloaded via the Coretax DJP portal under the XML template menu.

In the Invoice sheet, you must complete key data such as the 16-digit PKP NPWP, tax period and year, transaction code, and transaction date. For buyer identity, enter the buyer’s name using a dash (-), select the NIK identity option, and fill the identity number with all zeros, in accordance with DJP guidelines.

The DPP and VAT values must be filled in accurately, as the system will automatically calculate and validate them. If there is more than one item, use the DetailFaktur sheet to ensure the data structure is properly recognized by the system.

Read Also: Output Tax Invoice Guide for PKP

Converting Excel to XML

After all data has been completed, save the Excel file and run the official converter application. Select the Output Tax Invoice document type and save the result in XML format. This XML file is what you will later upload to Coretax.

This step is critical, as any XML format errors may cause the upload process to fail or result in incomplete validation status.

Uploading the Consolidated Tax Invoice in Coretax

Log in to Coretax DJP using your PKP account. Select the appropriate role, then navigate to the e-Faktur and Output Tax menu. Use the Import Data feature to upload the XML file you have prepared.

The system will display the processing status, from data validation to invoice creation. If all stages are successful, the invoice will appear in the Output Tax list.

Submission and Digital Signature

Once the invoice has been successfully imported, you are required to submit the invoice. This process requires an electronic certificate and passphrase as a digital signature. If successful, the invoice status will change to Issued and become legally valid.

Without submission, the tax invoice is considered not yet issued, even if it has already been uploaded.

Read Also: Output Tax Invoice: Functions, Examples, and How to Create One

Reporting in the VAT Periodic Tax Return (SPT Masa PPN)

Consolidated tax invoices with Issued status will be included in the VAT Periodic Tax Return (SPT Masa PPN). You must ensure the XML upload is placed in the correct section, such as I.A5, I.A9, or I.B, depending on the transaction code.

Coretax will calculate the VAT automatically. You only need to ensure the tax period is correct, make payment if there is an underpayment, then sign and submit the SPT.

Common Mistakes to Avoid

The most common errors include incorrect date formats, wrong transaction codes, and mismatched tax periods between the invoice and the SPT. Unstable internet connections can also cause upload or submission failures.

Careful review before uploading is essential to avoid the need for corrections later.

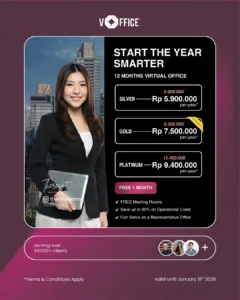

Simplify Your VAT Reporting with vOffice

As a PKP, we understand that creating consolidated tax invoices and reporting VAT Periodic Tax Returns requires high accuracy and a solid understanding of the Coretax system. If you want your tax processes to be more organized, compliant, and efficient, our accounting and tax reporting services and vOffice tax consulting services are the right solution.

We help ensure your tax invoices are properly prepared, SPTs are submitted on time, and the risk of errors is minimized. With professional support, you can focus on running your business without worrying about tax compliance.

Contact us for a FREE consultation!

FAQ About Consolidated Tax Invoices

Who is required to use a consolidated tax invoice?

Retail PKPs that sell directly to end consumers without complete buyer identification.

Can a consolidated tax invoice be created manually in Coretax?

No. Consolidated tax invoices can only be created by uploading an XML file using the official DJP template.

Is a consolidated tax invoice required to be reported in the VAT Periodic Tax Return?

Yes. Consolidated tax invoices are part of Output Tax and must be reported in the VAT Periodic Tax Return.

What if there is an error in a consolidated tax invoice?

Errors can be corrected through the issuance of a replacement tax invoice in accordance with the applicable Coretax DJP regulations.