Creating a bonded zone tax invoice in Coretax DGT requires the use of transaction code 07, calculation of DPP at 11/12, and validation of SPPB or BC 40 documents integrated with the Directorate General of Customs and Excise. If the steps are incorrect, the Directorate General of Taxes system may reject your invoice during upload or approval.

As a tax service provider, we frequently encounter issues at the stage of additional information input, “other value” DPP calculation, and the electronic signature (TTE) upload process. Below is a complete guide to ensure your invoice is approved without errors.

Initial Preparation Before Entering the Invoice

Log in to your Coretax account using your NPWP.

Prepare the following documents:

- SPPB or BC 40 number

- AJU number

- Buyer’s NPWP or NIK

- Detailed data of goods or services

For transactions with VAT facilities where VAT is not collected or borne by the government, use transaction code 07. This code is the primary attribute for bonded zone invoices.

Read Also: How to Create a Settlement Invoice in Coretax

Steps to Input an Output Tax Invoice

Go to the menu e-Faktur > Output Tax > Create Invoice.

- Select transaction code 07.

- Enter the invoice date according to the SPPB or BC 40 date.

- In additional information, select code 02 for bonded storage location.

- Enter the SPPB or AJU number in the supporting document section.

If the system shows a “Not Found” error, temporarily change the additional information to 01, re-enter the SPPB number, then switch it back to 02. This method often works to prefill buyer data from the Customs system.

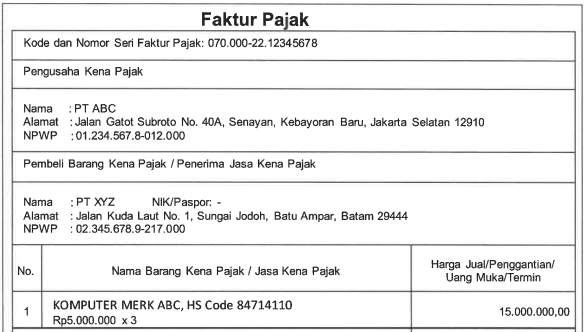

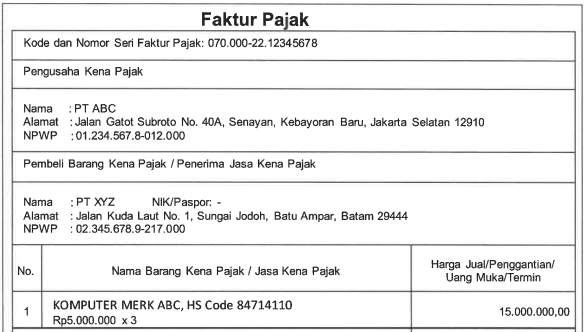

How to Fill in Transaction Details and 11/12 DPP

Click Add Transaction and complete:

- Type of goods or services

- Item name

- Unit

- Unit price

- Quantity

In the “Other Value DPP” section, change it to 11/12 of the total DPP.

Example:

Rp1,000,000 × 11/12 = Rp916,667

With a 12 percent VAT rate, the system will automatically generate an effective VAT of 11 percent in accordance with PMK 131/2024.

Make sure the totals and details are correct before clicking Save Draft.

Read Also: SPT Function: Tax Obligations & Benefits for Taxpayers

Upload Process and Electronic Signature

Return to the Output Tax menu and refresh the page.

Click the created code 07 invoice, then:

- Verify the buyer’s NPWP and SPPB number

- Ensure the 11/12 DPP calculation is correct

- Click Upload Invoice

- Enter the electronic certificate passphrase

- Confirm the signature

The system will process the invoice until a successful upload notification appears.

Read Also: How to Download NPWP in Coretax DGT: Complete Guide

Monitoring Approval Status

Monitor through XML Monitoring or the Output Tax list.

The status will change from:

CREATED → APPROVED

If it fails, it is usually due to:

- Customs data mismatch

- Incorrect SPPB number

- Incorrect DPP format

Make corrections and re-upload. Once approved, you can print the official invoice.

Common Challenges Faced by Taxpayers

Many taxpayers experience:

- Incorrect “other value” DPP calculation

- SPPB validation errors

- Electronic signature failure

- Status not changing to approved

Even minor mistakes can affect the Monthly VAT Return (SPT Masa PPN) and pose a risk of fiscal corrections.

Read Also: Coretax Activation for Individual and Corporate Taxpayers: Complete Guide

How to Ensure Safer and More Efficient Reporting

A bonded zone tax invoice is not just about inputting data into Coretax. You must also ensure consistency with the Monthly VAT Return (SPT Masa PPN), reconciliation of customs documents, and compliance with the latest regulations.

This is where we at vOffice support you.

Through our:

We ensure your invoices comply with regulations, are valid upon upload, and align with your monthly tax reports. You can focus on business operations without worrying about tax administration risks.

If you want a safer and more efficient process, our team is ready to assist you.

Contact us for a FREE consultation!

FAQ About Bonded Zone Tax Invoices

What transaction code is used for bonded zones in Coretax?

Transaction code 07 is used for transactions with VAT facilities where VAT is not collected or borne by the government.

Why must the DPP be calculated as 11/12?

Because with a 12 percent VAT rate, calculating the Tax Base (DPP) using the 11/12 scheme results in an effective VAT of 11 percent in accordance with PMK 131/2024.

What causes the “Not Found” error when entering the SPPB?

It usually occurs due to mismatched additional information, incorrect data input, or data not yet synchronized with the Directorate General of Customs and Excise (DJBC) system.

How do you know if the invoice is valid?

Check the status in XML Monitoring. If it shows APPROVED, the tax invoice is valid and can be printed.

Do bonded zone invoices affect the Monthly VAT Return (SPT Masa PPN)?

Yes. The DPP and VAT amounts must still be reflected in the Monthly VAT Return reporting even though the VAT facility (not collected) applies.