In Indonesia’s business landscape, entrepreneurs have various options when selecting the type of business entity. Two of the most common types are Limited Liability Company (PT) and Sole Proprietorship (UD). Each has unique characteristics, advantages, and disadvantages. Understanding the differences between PT and UD is crucial for entrepreneurs who want to start or grow their businesses. This article delves into the seven main differences between PT and UD, covering aspects such as legal structure, liability, capital, and business continuity.

Basic Definition

A Limited Liability Company (PT) is a legal entity regulated by Law No. 40 of 2007 concerning Limited Liability Companies. A PT has a separate legal status from its owners, meaning the company can own assets, enter contracts, and be legally responsible for its obligations. In a PT, the owner’s liability is limited to the shares they own.

A Sole Proprietorship (UD) is a simpler business structure without separate legal status. UD is typically owned and managed by one or more individuals without a distinction between personal and business assets. In a UD, the owner is fully responsible for all business obligations.

Also Read: Definition of PT (Limited Liability Company), Types, and Examples

Legal Structure

As a legal entity, a PT has a formal and organized structure. It includes a General Meeting of Shareholders (GMS), a Board of Directors, and a Board of Commissioners, each with specific authorities and responsibilities. This structure allows for more transparent and structured business operations.

Conversely, UD lacks a formal organizational structure. Decisions are made directly by the owner or manager without adhering to formal procedures. While this provides flexibility, it may also result in a lack of operational transparency.

Also Read: Legal Documents for PT: A Comprehensive Guide

Legal Liability

One of the main benefits of a PT is limited liability. If the company incurs losses or faces legal issues, the shareholders’ risk is limited to the value of their shares. This protects shareholders’ personal assets.

In contrast, UD owners have unlimited liability for all business obligations. If the UD incurs losses or legal issues, the owner must use personal assets to cover business debts, making UD riskier for owners.

Capital and Financing

PTs can raise larger amounts of capital compared to UDs. A PT can issue shares to the public and access financing sources such as bonds and bank loans. This allows PTs to make significant investments and grow quickly.

UD capital typically comes from the owner’s personal funds or loans from financial institutions with stricter conditions. Since UDs cannot issue shares or bonds, their available capital is often more limited.

Also Read: Capital for PT in Indonesia: A Legal Guide

Establishment Process

Establishing a PT is more complex than setting up a UD. A PT requires a deed of establishment from a notary and approval from the Ministry of Law and Human Rights. Additionally, PTs must fulfill several other administrative requirements.

In contrast, setting up a UD is much simpler and faster. Owners only need to register their business with the local government without complex formal processes, making UD a popular choice for beginner entrepreneurs.

Regulation and Administration

PTs are subject to strict regulations, including annual financial reporting, audits, and compliance with tax and labor laws. Adherence to these regulations ensures the company’s transparency and accountability.

For UDs, regulations are more lenient. There is no obligation to prepare formal financial statements or undergo annual audits, providing greater operational flexibility.

Business Continuity

The continuity of a PT is more assured due to its legal entity status, which allows the business to continue operating even with changes in ownership or management. This makes PTs suitable for long-term ventures.

In contrast, the continuity of a UD heavily depends on its owner. Changes in ownership or management can significantly impact the business.

Choosing between a Limited Liability Company (PT) and a Sole Proprietorship (UD) depends on the specific needs and goals of each entrepreneur. A PT offers better legal protection and the ability to raise significant capital but comes with a more complex establishment process and stricter regulations. Meanwhile, a UD provides ease of setup and operational flexibility but entails higher personal risk for the owner. Understanding these differences thoroughly helps entrepreneurs decide on the most suitable business entity for their vision.

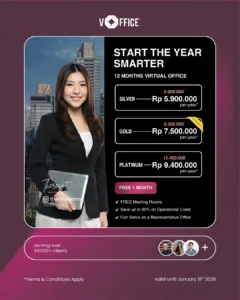

To simplify the establishment process of PT and legal documentation, use vOffice services. With vOffice, you will receive a strategically located virtual office, flexible service packages, and complete support facilities.

As an ISO 9001-certified company, vOffice has served over 50,000 clients across Indonesia and earned a MURI record in 2022 as the Virtual Office Provider with the Most Locations. With vOffice, you can focus on growing your business without worrying about legalities.

Contact us now to get special offers!

If you intend to start or grow a business, you can rely on the services of vOffice. Our professional team is ready to help with various business needs, such as;

- Establishment of Limited Liability Company (PT)

- Establishment of Commanditaire Vennootschap (CV)

- Haki / Indonesia trademark registration

- Tax Consultation

- Virtual Office

- Office Space for Rent

- Meeting Room Rental

- Rent a coworking space

- and various other services.

Contact us now and get special offers!