CAPEX (Capital Expenditure) refers to a company’s expenses for purchasing, upgrading, or repairing fixed assets used in long-term operations. These expenditures are crucial for supporting the company’s growth and efficiency. Examples include purchasing machinery, constructing buildings, or investing in technology.

This article will delve deeper into Capex and the essential aspects every entrepreneur should know.

What is Capex?

Capex, or Capital Expenditure, refers to expenses incurred by a company to acquire, upgrade, or maintain long-term assets that provide benefits for more than one accounting period. Examples of such assets include properties, machinery, and infrastructure. These expenditures aim to support business growth and ensure long-term operational sustainability.

Read More: 5 Differences Between Firms and Limited Liability Companies

Capex vs. Opex

The main difference between Capex and Opex (Operational Expenditure) lies in the nature of the expenses:

- Capex: Investments in fixed assets that provide long-term benefits, such as purchasing a building or new machinery.

- Opex: Routine operational costs needed to run daily business activities, like employee salaries and utility bills.

Types of Capex

Capex can be categorized based on its purpose:

- Expansion: Expenses to increase production capacity or introduce new products.

- Replacement: Costs to replace old assets with new ones to maintain efficiency.

- Maintenance: Investments to maintain existing assets in proper working condition.

Read More: How to Check PT Names: A Complete Guide for Business Legalities

Calculating Capex

Understanding the amount of investment in fixed assets is essential. The basic formula to calculate Capex is:

Where:

- Change in Fixed Assets: The difference in fixed asset values between two periods.

- Depreciation: The allocated cost for reducing the value of fixed assets over a specific period.

Read More: 7 Differences Between Cooperatives and PT: Understanding Their Characteristics

In addition to understanding Capex, entrepreneurs should also be aware of the required capital to establish a company. Check out the complete guide in the article Capital Requirements for PT in Indonesia: A Legal Guide.

FAQs

Are intangible assets included in Capex?

Yes, intangible assets such as patents and software can be categorized as Capex if they provide long-term benefits.

Is patent cost considered Capex?

Yes, the cost of acquiring a patent is considered Capex as it is an investment in intangible assets with long-term value.

Is software classified as Capex or Opex?

Software can be classified as Capex if purchased as a long-term asset. However, subscription costs for software are typically considered Opex.

What percentage of Capex constitutes Opex?

There is no fixed percentage as Capex and Opex are two separate categories of expenses. However, companies must manage both types of expenditures effectively to ensure operational continuity and business growth.

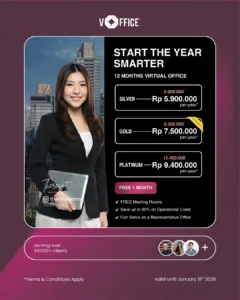

Easier PT Establishment with vOffice

The process of establishing a PT in Indonesia can be time-consuming. To address this, you can rely on PT Establishment Services by vOffice, which offers complete legal solutions.

With vOffice’s service packages, you can enjoy benefits like:

- Free Consultation

- Bonus Virtual Office

- PT Name Check

- Account Opening Assistance

- Processing EFIN, SK Kemenkumham, NIB, NPWP, and SKT

With vOffice’s support, you can focus on growing your business without worrying about administrative tasks. Additionally, you’ll receive a strategic business address, comprehensive supporting facilities, and professional services to boost your company’s credibility.

Contact us now and get a special offer!

If you intend to start or grow a business, you can rely on the services of vOffice. Our professional team is ready to help with various business needs, such as;

- Establishment of Limited Liability Company (PT)

- Establishment of Commanditaire Vennootschap (CV)

- Haki / Indonesia trademark registration

- Tax Consultation

- Virtual Office

- Office Space for Rent

- Meeting Room Rental

- Rent a coworking space

- and various other services.

Contact us now and get special offers!