Are you looking to learn more about Indonesia’s tax system? Look no further! This article provides a comprehensive beginner’s guide to the Indonesian tax system, including key considerations for those looking to understand and comply with Indonesian tax regulations. We’ll walk you through the basics of the Indonesian tax system, how to apply for tax amnesty in Indonesia, and more. With this comprehensive guide, you’ll have a better understanding of the Indonesian tax system and can be sure that you’re in compliance with the law.

Understanding the Indonesian Tax System

- Tax Indonesia is the implementation of laws and regulations which govern taxation in Indonesia.

- Taxpayers are required to pay taxes to the government and are liable to comply with the provisions of the applicable tax laws.

- The Indonesian tax system is based on a progressive scale, meaning that individuals and businesses with higher incomes pay a higher percentage of taxes.

- Taxes are primarily collected by the Directorate General of Taxes (DGT), which is part of the Ministry of Finance.

- The DGT is responsible for collecting income taxes, value-added taxes (VAT), and other taxes.

- The Indonesian government also offers tax amnesty programs from time to time, allowing taxpayers to pay lower taxes in exchange for disclosing their previously unreported income or assets.

Key Components of Tax Indonesia

- Tax Amnesty Indonesia: Tax amnesty is a government program that allows taxpayers to declare previously undeclared income and/or assets without incurring any penalties or fines. In Indonesia, the tax amnesty program is one of the most important components of the tax system.

- Income Tax: All individuals are subject to income tax on their worldwide income. The tax rate depends on income bracket and taxpayer’s residency status. Taxpayers can choose to pay income tax directly or be deducted from their monthly salary.

- Corporate Income Tax: Corporate income tax applies to all entities carrying out commercial activities in Indonesia. The tax rate is currently 20%. Taxpayers are required to file their annual tax returns before the 31st of March each year.

- Value Added Tax (VAT): VAT is a consumption tax levied on the sale of goods and services. The tax rate is currently 10%. All businesses with annual sales of more than IDR 4.8 billion are required to register for and charge VAT.

- Withholding Tax: Withholding tax is a tax imposed on payments made by companies to non-resident taxpayers. The tax rate varies depending on the type of payment and the country of residence of the taxpayer. All companies are required to withhold tax from payments made to non-resident taxpayers.

- Tax Treaties: Indonesia has entered into double tax treaties with several countries, including Singapore, Japan, and the United Kingdom. These treaties help to reduce or eliminate double taxation of income earned in one country by a resident of another country.

Tax Amnesty Indonesia: What You Need to Know

- What is Tax Amnesty Indonesia? Tax Amnesty Indonesia is a program launched by the Indonesian government in 2016 designed to encourage citizens and businesses to declare previously undisclosed income and assets. The program offers a range of incentives and lower rates of taxation in exchange for the declaration and payment of taxes.

- What are the Benefits ? By using the Tax Amnesty Indonesia program, citizens and businesses can take advantage of a reduced tax rate, exemptions from certain taxes, and a waiver of penalties for late payments. The program also offers the opportunity for participants to come into compliance with their taxation obligations without fear of criminal prosecution.

- Who is Eligible ? Tax Amnesty Indonesia is open to all Indonesian citizens and businesses who have previously not reported income or assets either domestically or abroad. Participants must declare all their income and assets to be eligible.

- What are the Requirements ? To be eligible for Tax Amnesty Indonesia, participants must complete a declaration form, provide proof of income and assets, and pay all applicable taxes. Participants must also agree to comply with all taxation laws in the future.

- What is the Deadline ? The deadline for Tax Amnesty Indonesia is March 31, 2020. Participants should apply before this deadline to take advantage of the program.

Common Taxation Terms Used in Indonesia

- PPh Pasal 21: This is the personal income tax for employees, which is calculated based on their salaries. It is a flat rate of 5%.

- PPh Pasal 25: This is the income tax rate imposed on those who are self-employed, or are engaging in certain independent activities such as consulting, giving lectures etc. It is a progressive tax rate and ranges from 0-30%.

- PPh Pasal 26: This is the income tax rate imposed on those who are receiving income from investments such as dividends or capital gains. The rate is a flat rate of 15%.

- PPh Pasal 4 (2): This is the income tax rate imposed on certain services or sales of goods. It is a progressive tax rate and ranges from 0-30%.

- PPN: This is the Value Added Tax that is imposed on goods and services. It is a flat rate of 10%.

- Tax Amnesty: This is a program offered by the Indonesian government to encourage taxpayers to declare their income and pay any outstanding tax liabilities. Tax Amnesty Indonesia is a great way for taxpayers to come into compliance with their obligations.

Tax Planning and Compliance in Indonesia

Tax planning and compliance is an integral part of doing business in Indonesia. To ensure compliance with Indonesia’s tax regulations, you must have a solid understanding of the Indonesian tax system. This section outlines key points to help you stay compliant with Indonesian tax law.

- Businesses in Indonesia are obligated to report and pay taxes quarterly.

- Taxpayers must submit tax returns and pay taxes by the due date to avoid penalties.

- The Indonesian government offers a tax amnesty program for those who have unpaid taxes.

- Foreign investors must register for a tax identification number (NPWP) when doing business in Indonesia.

- Tax deductions are available for expenses related to business operations.

- Taxpayers must keep detailed records of all transactions and retain them for auditing purposes.

- Professional help is recommended to ensure compliance with Indonesian tax regulations.

Proper tax planning and compliance is essential for businesses in Indonesia. By understanding the Indonesian tax system and taking advantage of available tax deductions, businesses can minimize their tax liability and maximize their profits. For more information on tax planning and compliance in Indonesia, seek the advice of a qualified tax professional or consult the Indonesian tax authority.

In conclusion, understanding the Indonesian Tax System can be a difficult process, but with the right knowledge and resources, it can be done. It is important to stay up to date with the ever-changing regulations and tax amnesty programs in Indonesia. Tax Indonesia is a complex system and understanding it is imperative for businesses looking to operate in the country. Tax amnesty programs like the one in Indonesia can be beneficial to both the government and taxpayers, as it encourages compliance and provides the opportunity to make up for past mistakes. With the help of this beginner’s guide, you can now understand the basics of the Indonesian Tax System and take advantage of the tax amnesty program in Indonesia.

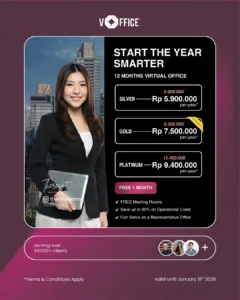

Overall, vOffice Indonesia offers a comprehensive suite of services to support your business needs, including assistance with navigating the Indonesian tax system. Whether you’re a small business owner or a foreign investor, vOffice Indonesia can provide the guidance and resources you need to ensure tax compliance and minimize your tax burden. Contact us today to learn more about our services and how we can help your business succeed in Indonesia