Progressive tax is a taxation system in which the tax rate increases as income or the value of the taxable object rises. This article explains the definition, legal basis, and how to calculate it.

What is a Progressive Tax?

A progressive tax is a taxation system where the tax rate increases as income or the value of the taxable object rises. This means that the higher a person’s income, the higher the percentage of tax they must pay. This system aims to create social justice by imposing higher taxes on those with greater economic capacity.

This tax concept is commonly applied to income tax (PPh), where taxpayers with lower incomes are subject to lower tax rates, while those with higher incomes are taxed at higher rates. This system is considered fair as it takes into account each individual’s economic capability.

Also Read: What is Value-Added Tax (VAT)?

When Are We Subject to Progressive Tax?

It is usually imposed on personal or corporate income that exceeds a certain threshold. In Indonesia, progressive tax primarily applies to income tax (PPh) for individual taxpayers. Below are some situations where progressive tax applies:

- Annual Income: If your annual income exceeds the non-taxable income threshold (PTKP), you will be subject to progressive tax.

- Asset Sales: Certain types of asset sales, such as property, may also be subject to progressive tax depending on the transaction value.

- Inheritance or Gifts: In some cases, high-value inheritances or gifts may also be subject to progressive tax.

Progressive tax is not only applicable in Indonesia but is also implemented in many other countries to reduce economic inequality and increase state revenue.

Also Read: What is NPWP: Definition, Types, and Requirements

Legal Basis of Progressive Tax in Indonesia

In Indonesia, the legal basis for implementing progressive tax is regulated under Law No. 36 of 2008 on Income Tax (PPh). Below are some key points from the law:

- Income Tax Rates: Article 17 of the Income Tax Law regulates progressive tax rates for individual taxpayers. These rates vary based on the amount of taxable income.

- Non-Taxable Income (PTKP): Article 7 of the Income Tax Law regulates PTKP, which is the income threshold not subject to tax. This varies depending on marital status and dependents.

- Taxable Objects: Article 4 of the Income Tax Law explains the types of income subject to tax, including income from employment, business, or other activities.

This legal foundation serves as a guideline for the Directorate General of Taxes (DJP) in enforcing the progressive tax system in Indonesia.

Tax Rates

The progressive tax rates for individual taxpayers in Indonesia are regulated under Article 17 of the Income Tax Law. Below are the applicable rates:

- Income up to IDR 60 million: 5% tax rate.

- Income above IDR 60 million up to IDR 250 million: 15% tax rate.

- Income above IDR 250 million up to IDR 500 million: 25% tax rate.

- Income above IDR 500 million up to IDR 5 billion: 30% tax rate.

- Income above IDR 5 billion: 35% tax rate.

These rates apply to taxable income after deducting PTKP and other deductions.

Also Read: How to Easily and Quickly File an Annual Tax Return

Example of Tax Calculation

To understand how these tax rates work, here are some examples of income tax calculations:

Example 1:

Annual income: IDR 300 million

Status: Single (PTKP: IDR 54 million)

- Taxable income: IDR 300 million – IDR 54 million = IDR 246 million.

- Tax payable:

- IDR 60 million x 5% = IDR 3 million

- (IDR 246 million – IDR 60 million) x 15% = IDR 27.9 million

- Total tax: IDR 3 million + IDR 27.9 million = IDR 30.9 million.

Example 2:

Annual income: IDR 600 million

Status: Married with 2 children (PTKP: IDR 67.5 million)

- Taxable income: IDR 600 million – IDR 67.5 million = IDR 532.5 million.

- Tax payable:

- IDR 60 million x 5% = IDR 3 million

- IDR 190 million x 15% = IDR 28.5 million

- IDR 250 million x 25% = IDR 62.5 million

- (IDR 532.5 million – IDR 500 million) x 30% = IDR 9.75 million

- Total tax: IDR 3 million + IDR 28.5 million + IDR 62.5 million + IDR 9.75 million = IDR 103.75 million.

How to Calculate Progressive Tax

Calculating progressive tax requires an understanding of taxable income and applicable rates. Here are the steps:

- Determine Gross Income: Calculate your total annual income.

- Deduct PTKP: Subtract PTKP based on your marital and dependent status.

- Calculate Taxable Income: The result is your taxable income.

- Apply the Tax Rates: Use the progressive tax rates for each income bracket.

- Sum Up the Tax: Add up the tax from each income bracket to get the total tax payable.

Progressive tax is a fair taxation system as it considers taxpayers’ economic capacity. With increasing rates based on income, this system helps reduce economic inequality and boost state revenue. In Indonesia, progressive tax is regulated under the Income Tax Law and applies to individual taxpayers.

Understanding how to calculate progressive tax is essential for tax compliance and avoiding reporting errors. By knowing the legal basis, rates, and calculation examples, you can better prepare for your tax obligations.

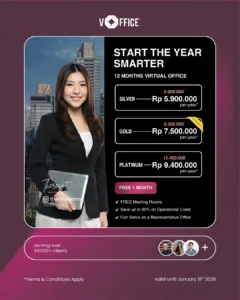

If you need assistance with tax management, you can rely on tax consultancy services from vOffice. Our team can assist you with various tax-related matters, including: