What Is a Tax Object?

A tax object refers to anything subject to taxation under the prevailing laws and regulations in Indonesia. In the context of the national tax system, a tax object includes economic activities, income, or assets that can be taxed and serve as a source of state revenue.

Read Also: Understanding Periodic Income Tax Return (PPh 21)

Legal Basis of Tax Objects

The determination of a tax object is not arbitrary. It is based on clear and strong legal foundations outlined in several tax laws, including:

Law No. 36 of 2008 on Income Tax (PPh) – regulates tax objects in the form of income received by taxpayers.

Law No. 42 of 2009 on Value Added Tax (VAT) – defines taxable goods and services as tax objects.

Regulations from the Ministry of Finance and DGT Circulars – provide technical guidance and further explanations.

Based on these legal grounds, the Directorate General of Taxes (DGT) issues regulations to ensure tax objects are imposed fairly and systematically.

Read Also: Penalties for Failing to Report Assets in the Tax Return

Types of Tax Objects

Tax objects are categorized based on the type of tax. Here are some common types of tax objects in Indonesia:

Income

All increases in economic capacity received or obtained by the taxpayer, including salaries, honorariums, dividends, interest, and business profits.Taxable Goods (BKP)

Tangible or intangible goods that are subject to VAT during sale, import, or export transactions.Taxable Services (JKP)

Services in business activities that provide benefits and are subject to VAT, such as consulting, architecture, and technology services.Specific Assets and Wealth

For example, land and building ownership, which are subject to Land and Building Tax (PBB).Certain Transactions

For instance, electronic transactions or property sales that are subject to Land and Building Rights Acquisition Duty (BPHTB).

Read Also: Easy and Quick Way to Report Annual Personal Tax Return

Items Not Considered as Tax Objects

Not all income or transactions are subject to taxation. Some items are explicitly excluded from tax objects, including:

Gifts received from family members or certain religious/social organizations.

Inheritance, as it is not the result of active economic activities.

Aid or social donations, as long as there is no reciprocal benefit or business gain.

Certain foreign-sourced income, if it meets specific criteria and has been taxed in the country of origin.

Why Is Understanding Tax Objects Important?

Understanding tax objects is essential for all taxpayers, both individuals and business entities. Misidentifying a tax object can lead to fines, penalties, or even legal actions. Moreover, this knowledge helps ensure more efficient and compliant tax planning.

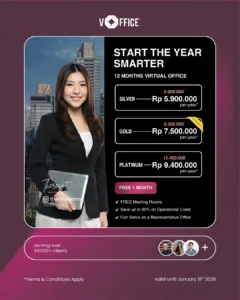

If you need assistance with tax management in Indonesia, you can rely on tax consultancy services from vOffice. Our team can assist you with various tax-related matters, including:

- Accounting services, financial report preparation, and tax reporting

- Payroll Management and Processing Services

- PKP Registration Services in Jakarta and Surrounding Areas

Get a FREE consultation now and enjoy special offers!

FAQ About Tax Objects

1. Is salary considered a tax object?

Yes, salary is a form of income subject to Income Tax (PPh).

2. Are lottery prizes considered tax objects?

Correct. Prizes from lotteries, contests, or other activities are taxable under Article 4 paragraph (2) of the Income Tax Law.

3. Is foreign-sourced income taxed in Indonesia?

It depends on the Double Taxation Avoidance Agreement (P3B) between Indonesia and the source country.

4. Are donated goods always tax-free?

Not always. Only certain donations are exempt, depending on the recipient and the purpose of the gift.

Read Also: Penalties for Failing to Report Assets in the Tax Return