Monthly Tax Returns (SPT Bulanan) are reports submitted by taxpayers every month to the Directorate General of Taxes (DJP). These reports contain information regarding the withholding, collection, or payment of taxes such as Income Tax (PPh) and Value Added Tax (VAT) that occurred during the reporting month. The goal is to ensure that tax obligations are fulfilled regularly and transparently.

Unlike Annual Tax Returns (SPT Tahunan), which report tax accumulation over a year, Monthly Tax Returns focus on a shorter, recurring period. They are especially important for businesses and employers who conduct transactions and pay salaries on a regular basis.

Also Read: How to File Your Annual Personal Tax Return Easily and Quickly

Types of Tax Returns You Should Know

There is more than one type of Monthly Tax Return. Common types include:

- SPT Masa PPh 21: For reporting employee income tax.

- SPT Masa VAT: Reported by Taxable Entrepreneurs (PKP) for taxable goods/services sales and purchases.

- SPT Masa PPh 23/26: For specific transactions such as services, rent, and royalties.

- SPT Masa PPh 4(2): For final tax objects such as land and building rentals.

Each type has different formats and required attachments. Choosing the wrong form may result in an invalid report.

Also Read: What is NPWP: Definition, Types, and Requirements to Get One

When and How to File?

Monthly Tax Returns must be submitted no later than the 20th of the following month after the tax period ends. For example, the return for January must be filed by February 20.

Filing is now easier as it can be done online through DJP Online e-Filing. Some taxpayers, such as Taxable Entrepreneurs, are also required to use the e-Invoice (e-Faktur) and e-Withholding (e-Bupot) systems to support the process.

What Are the Risks of Not Filing?

Failure to file a Monthly Tax Return or filing it incorrectly may lead to the following risks:

- Administrative fines starting from IDR 100,000 per return type

- Interest penalties for late payments

- Tax audits that may disrupt business operations

Also Read: What is Value Added Tax (VAT)?

The Importance of Monthly Tax Compliance for Businesses

For companies and MSMEs, compliance with monthly tax reporting reflects healthy financial management and administrative discipline. It is also a key requirement when applying for tenders, loans, and financial audits.

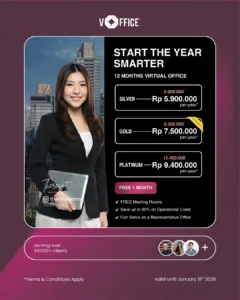

If you need assistance with tax matters, you can rely on vOffice’s tax consultancy services. Our team can assist you with all your tax needs, including:

- Accounting services, financial report creation, and tax reporting

- Payroll Management Services

- PKP Registration Services in Jakarta and surrounding areas

Get a FREE consultation now and enjoy special offers

FAQ

What is the difference between Monthly and Annual Tax Returns?

Monthly Tax Returns are filed every month for specific tax types, while Annual Tax Returns are submitted once a year as a summary report.

Who is required to file Monthly Tax Returns?

Businesses, employers, and individuals who withhold or collect taxes such as Income Tax Article 21 (PPh 21), VAT, etc.

Do I need to file a Monthly Return if there are no transactions?

Yes. Taxpayers must still submit a zero (Nihil) return to avoid penalties.

How do I file a Tax Return online?

Through the DJP Online portal using an e-Filing account and supporting apps such as e-Bupot and e-Faktur.

What are the consequences of late submission?

You may incur administrative sanctions in the form of fines and/or interest penalties.