A nil VAT Periodic Tax Return must still be filed by every VAT-registered business (Pengusaha Kena Pajak/PKP) through Coretax DJP, even if there were no transactions during a particular tax period. This obligation is regulated under the General Tax Provisions and Procedures Law (UU KUP) and applies on a monthly basis to maintain tax administrative compliance.

We often encounter business owners, consultants, and freelancers who assume they do not need to file because there is no VAT payable. In fact, a nil status does not eliminate the obligation to submit the return.

What Is a Nil VAT Periodic Tax Return?

A nil VAT Periodic Tax Return is a VAT report in which both output VAT and input VAT are recorded as zero. This situation occurs when a PKP does not make any taxable supplies of goods (BKP) or services (JKP) during a specific tax period.

Even without transactions, the Directorate General of Taxes (DJP) still requires filing to ensure that PKP status remains active and tax data stays synchronized.

Read Also: Understanding VAT Periodic Tax Returns (SPT Masa PPN)

Filing Obligations and Deadlines in Coretax

VAT Periodic Tax Returns must be filed monthly, no later than the end of the following month after the tax period ends. Late filing may result in an administrative penalty of IDR 500,000 per tax period.

Starting in 2025, Coretax DJP has become the main system integrating tax reporting, payments, and digital tax administration.

Preparation Before Filing a Nil VAT Return

Before submitting a nil VAT Periodic Tax Return in Coretax DJP, make sure the following requirements are fulfilled to ensure a smooth process:

- Corporate NPWP or responsible person’s NIK registered as an active PKP

- An active Coretax DJP account, including NIK-based username and password

- A valid electronic certificate (e-certificate)

- The e-certificate passphrase for the digital signature process

- Company account access rights enabled if logging in for the first time using a personal account

- The correct tax period according to the month and year being reported

- Internal documentation confirming no transactions, such as records showing no BKP or JKP supplies (no upload required)

These preparations are essential to avoid technical issues or a failure to submit the tax return.

Read Also: How to Check Tax Returns Already Filed in Coretax DJP: A Complete Guide from vOffice

Steps to File a Nil VAT Periodic Tax Return in Coretax

Below is a practical workflow for filing a nil VAT Periodic Tax Return via Coretax DJP:

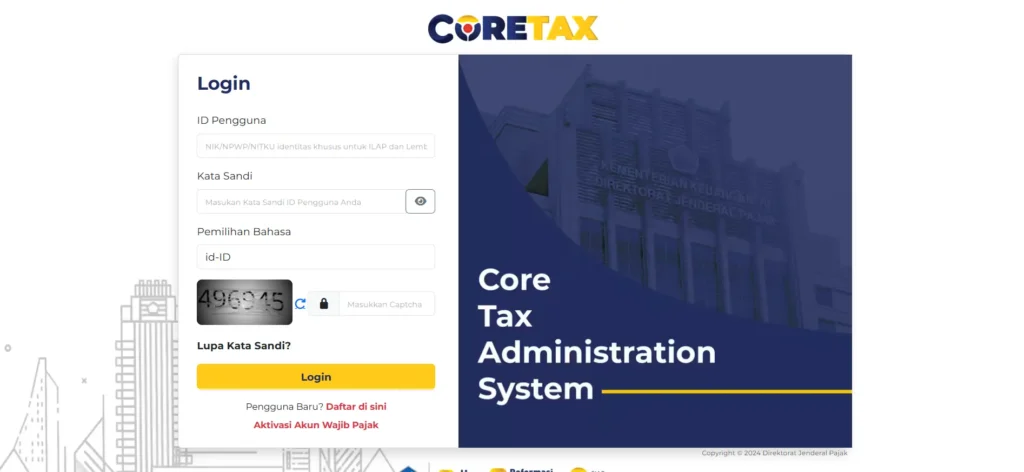

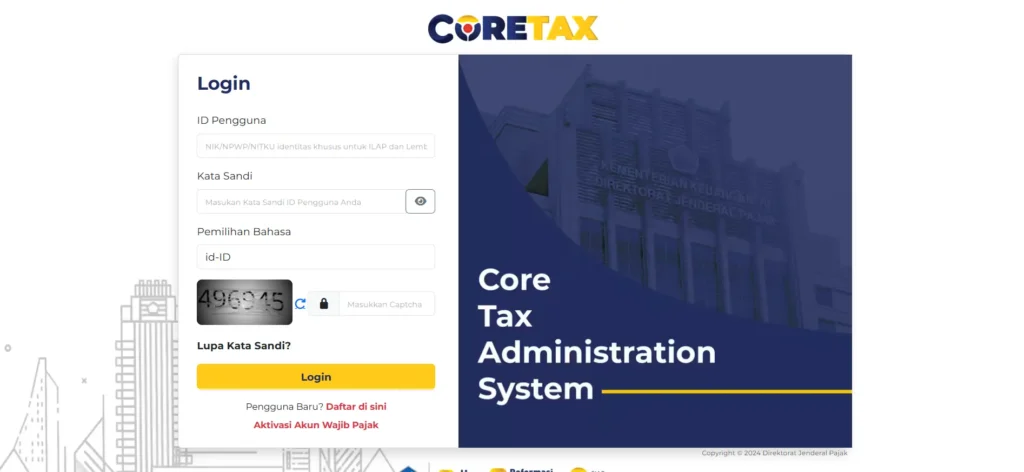

Access Coretax DJP

Log in to https://coretaxdjp.pajak.go.id using the responsible person’s NIK, password, and captcha.

Select the Taxpayer Profile

After logging in, switch to the corporate or business taxpayer profile to be reported.

Create a Draft Tax Return

- Go to the SPT menu

- Select Create Draft SPT

- Choose the tax type VAT, the relevant tax period, and normal filing

Verify Nil Data

- Output VAT is recorded as 0

- Input VAT is recorded as 0

- No VAT payable

Save and Post the Draft

Click save and proceed until the draft status is ready for submission.

Statement of Accuracy

Tick the statement of accuracy and enter the reporter’s position according to the company structure.

Electronic Signature

Enter the e-certificate passphrase to digitally sign the tax return.

Confirmation and Download Proof

Ensure the success notification appears, then download:

- Electronic Receipt (Bukti Penerimaan Elektronik/BPE)

- A copy of the VAT Periodic Tax Return

Common Mistakes When Filing a Nil VAT Return

We often find the following mistakes that cause a return to be considered unfiled or problematic:

- Assuming a nil return does not need to be filed, when it is still mandatory

- Forgetting to complete the electronic signature, leaving the return in draft status

- Selecting the wrong tax period, especially when filing close to the deadline

- Incomplete account access rights, particularly when filing is delegated

- An expired electronic certificate, causing submission failure

- Failing to download the BPE, even though it is crucial as official proof of filing

By avoiding the mistakes above, filing a nil VAT Periodic Tax Return can be faster and more secure.

Read Also: How to Print VAT Return Attachments in Coretax: A Complete Guide from vOffice

Benefits of Timely Filing

Timely filing helps maintain a strong tax compliance record, simplifies other administrative processes, and avoids unnecessary penalties.

For growing businesses, this compliance is essential to ensure smooth operations and build trust with partners.

Need Professional Assistance?

If you want your nil VAT Periodic Tax Return to be filed smoothly without hassle, we at vOffice are ready to help. Our Accounting and Tax Reporting Services and vOffice tax consulting services are designed to simplify your business tax obligations.

We ensure every return complies with DJP regulations, is filed on time, and is properly documented—so you can focus on growing your business.

Contact us for a FREE consultation!

FAQ About Nil VAT Periodic Tax Returns

Is a nil VAT return required to be filed every month?

Yes. As long as PKP status is active, the VAT Periodic Tax Return must be filed every month even if it is nil.

What are the penalties for not filing a nil VAT return?

The DJP may impose an administrative fine of IDR 500,000 for each tax period that is late or not filed.

Do I need to upload proof of nil transactions to Coretax?

No. Proof of nil transactions does not need to be uploaded and only needs to be kept as internal documentation if required.

Who is authorized to sign the tax return in Coretax?

The PKP’s responsible person or an authorized representative with a valid electronic certificate.

Can VAT return filing be delegated?

Yes, as long as access rights and power of attorney have been properly set up in Coretax DJP.