If you’ve ever made a mistake when creating a Unification Tax Withholding Slip through DJP Online, you’re not alone. Many taxpayers have experienced similar issues—whether it’s entering the wrong NPWP, date, income type, or tax amount. Fortunately, DJP provides a secure and official cancellation feature.

This article will walk you through the process clearly, completely, and in an easy-to-understand way.

What Is a Unification Tax Withholding Slip?

A Unification Tax Withholding Slip is an electronic document that records income tax deductions, such as PPh Article 21, 23, and 26. It is created by the tax withholder through the e-Bupot DJP system and serves as an official archive for the Periodic Tax Return (SPT Masa) report.

Read also: Sanctions for Not Reporting Assets in Your Tax Return

When Should a Withholding Slip Be Cancelled?

A cancellation is needed if any of the following mistakes occur:

- Incorrect recipient information (NPWP/Name)

- Incorrect income type or tax rate

- Incorrect deduction amount

- The withholding should not have occurred (e.g., transaction was canceled)

Steps to Cancel a Withholding Slip on DJP Online

Log in to DJP Online

Sign in using your NPWP and password at https://djponline.pajak.go.id

Select the e-Bupot Unification Menu

Choose the tax type you want to cancel, such as PPh 21/26.

Find the Withholding Slip to Be Cancelled

Use the search feature to locate the document you wish to cancel.

Click “Cancel” or “Amendment”

Depending on the situation, you can:

- Click “Cancel” if the withholding slip is entirely incorrect.

- Click “Amendment” if only some of the data needs to be corrected.

Enter the Cancellation Reason

Provide a clear explanation for the cancellation. This is important for audit justification by the DJP.

Save and Submit

Save your changes and submit the form.

Download the Cancellation Receipt

The system will record the status as “Cancelled.” Save the PDF as a record for your archives.

Read also: Late Filing Solutions for Annual Tax Return (SPT)

Things to Note

- Cancelled slips cannot be restored or deleted.

- The DJP retains audit logs of the cancellation.

- Cancel the slip before filing your Periodic Tax Return (SPT Masa) to avoid data inconsistencies.

- The cancellation must be done by the authorized party (the withholder, not the recipient).

Read also: How to File an Individual Annual Tax Return Easily and Quickly

Why You May Need Professional Help

Although it may seem simple, many taxpayers make critical mistakes during this process—mistakes that can lead to fines, tax corrections, or even audits. If you’re unsure whether you’re taking the correct steps, using an Online Tax Consultation Service can be very helpful.

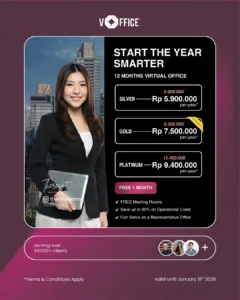

If you need assistance with tax matters, you can rely on vOffice’s tax consultancy services. Our team can assist you with all your tax needs, including:

- Accounting services, financial report creation, and tax reporting

- Payroll Management Services

- PKP Registration Services in Jakarta and surrounding areas

Get a FREE consultation now and enjoy special offers

FAQ About Cancelling Unification Tax Withholding Slips

Q: Can a withholding slip be deleted?

A: No, it can only be cancelled and replaced.

Q: Who is authorized to cancel the slip?

A: Only the withholder (income provider), not the recipient.

Q: Does cancellation affect the SPT?

A: Yes, make sure to cancel before filing the SPT.

Q: Can it be cancelled after the SPT has been filed?

A: Yes, but you’ll need to amend your SPT first.