The gig economy has changed the global job landscape, including in Indonesia. More and more individuals are choosing a career as a freelancer, offering their expertise in various fields such as writing, graphic design, web development, consulting, and more. The flexibility of time and the potential for attractive income are the main attractions of this work model. However, alongside the freedom and opportunities it offers, there is also a responsibility that is often overlooked: tax obligations.

Many freelancers, especially those just starting their careers, may feel confused or even ignore tax matters. Basic questions such as “Do freelancers have to pay taxes?” and “How do you calculate freelance taxes?” often become intimidating. In fact, understanding and fulfilling tax obligations is an important part of being a responsible professional and contributing positively to the country. This article serves as a complete guide to answer those questions and help freelancers in Indonesia better understand and manage their tax obligations.

Are Freelancers in Indonesia Required to Pay Taxes?

The clear answer to this question is YES, freelancers in Indonesia are required to pay taxes. As citizens with income, freelancers have the same obligation as formal workers to pay taxes in accordance with the applicable laws in Indonesia.

The legal basis regulating tax obligations for freelancers is essentially the same as for other workers or business actors, which include:

- Law No. 36 of 2008 on Income Tax (PPh): This law regulates the imposition of tax on income received or earned by taxpayers, including freelancers. Income from freelance work is included in the definition of income subject to tax.

- Government Regulations (PP) and Minister of Finance Regulations (PMK): The government provides further guidelines on implementing tax obligations through these regulations, including the methods of calculating and paying taxes.

Therefore, neglecting tax obligations as a freelancer can result in administrative sanctions in the form of fines or even criminal sanctions in accordance with tax regulations.

Why Do Freelancers Have to Pay Taxes?

Paying taxes is not only a legal obligation but also a tangible contribution of citizens to the development and progress of the nation. Tax funds collected by the government are used to finance various public programs and services such as infrastructure, education, health, security, and more.

For freelancers themselves, paying taxes also has several benefits, including:

- Legal Compliance: Fulfilling tax obligations protects freelancers from the risk of legal sanctions and fines in the future.

- Professional Reputation: As a professional, paying taxes demonstrates integrity and responsibility to the country.

- Access to Public Services: By paying taxes, freelancers contribute to financing public services that they too can enjoy.

- Ease of Administrative Matters: Proof of tax payment may be required in various administrative matters such as loan applications or visa processing.

Types of Taxes Applicable to Freelancers in Indonesia

As a freelancer, the main tax type you need to be aware of is Income Tax (PPh). However, under certain conditions, you may also need to consider Value-Added Tax (PPN).

4.1. Income Tax (PPh)

PPh is the tax imposed on income received or earned by freelancers in a tax year. There are two mechanisms for collecting PPh that may apply to freelancers:

4.1.1. PPh Article 21: If Receiving Income from an Employer Who Withholds Tax

If you work as a freelancer for a company or business entity and they withhold PPh from the income you receive, the employer will report and remit the tax. You will receive a PPh Article 21 tax slip, which you will need to attach to your Annual Income Tax Return (SPT).

4.1.2. PPh Article 25: Self-Payment of Income Tax

In many cases, especially if you work with multiple clients or independently, you as a freelancer are responsible for calculating, paying, and reporting your own income tax through the PPh Article 25 mechanism. PPh Article 25 payments are made monthly and reported in the Annual Tax Return.

4.2. Value-Added Tax (PPN): Limits and Obligations

PPN is a tax imposed on the consumption of goods or services within the country. As a freelancer, you may be required to collect and remit PPN if your gross income in a tax year exceeds the limit set by the government. Currently, the threshold for being a taxable entrepreneur (PKP) is a gross income of more than Rp4,800,000,000 (four billion eight hundred million rupiah) per year. If your income is below this threshold, you are not required to become a PKP and do not need to collect PPN. However, you are still required to pay PPh on your income.

How to Calculate Income Tax (PPh) for Freelancers

Calculating PPh for freelancers involves several steps. Here is a step-by-step guide you can follow:

5.1. Calculating Gross Income

Gross income is the total income you receive from your freelance work during a tax year (January 1 to December 31). This includes all payments from clients, whether in cash, bank transfers, or other forms.

Example: If in 2024 you received a total of Rp100,000,000 from various freelance projects, your gross income would be Rp100,000,000.

Also read: Check Business Zoning in Jakarta: A Complete Guide for Entrepreneurs

5.2. Determining Net Income

Net income is your gross income minus expenses related to your freelance activities. There are two ways to determine net income:

5.2.1. Standard Calculation of Net Income (NPPN)

NPPN is a specific percentage set by the Directorate General of Taxes (DJP) for different types of freelance work. If you choose to use NPPN, you don’t need to record your actual expenses. Instead, you multiply your gross income by the applicable NPPN percentage for your type of work. The NPPN percentage list is available on the DJP website.

Example: If you are a freelance writer and the NPPN for this work is 50%, your net income would be Rp100,000,000 x 50% = Rp50,000,000.

5.2.2. Recording Actual Expenses

If you choose this method, you need to record all expenses directly related to your freelance activities. These expenses will later be subtracted from your gross income to determine your net income. The list of deductible expenses will be discussed further in the next section.

Example: If your gross income is Rp100,000,000 and deductible expenses total Rp30,000,000, your net income would be Rp100,000,000 – Rp30,000,000 = Rp70,000,000.

Important to note: You must choose one method to calculate net income and consistently use it.

Also read: What is a Tax Notification Letter (SPT)?

5.3. Calculating Taxable Income (PKP)

Taxable Income (PKP) is the net income subject to tax. To calculate PKP, you need to subtract the Non-Taxable Income (PTKP) from your net income.

5.3.1. Non-Taxable Income (PTKP)

PTKP is the income threshold that is not subject to tax. The amount of PTKP varies depending on your marital status and the number of dependents you have. Here are the current PTKP amounts:

- Individual Taxpayer: Rp54,000,000

- Additional for married taxpayers: Rp4,500,000

- Additional for each dependent (maximum of 3 people): Rp4,500,000 per person

Example: If you are a freelancer who is unmarried and have no dependents, your PTKP is Rp54,000,000. If your net income is Rp70,000,000, your PKP would be Rp70,000,000 – Rp54,000,000 = Rp16,000,000.

5.4. Applying Income Tax Rates (PPh)

After determining your PKP, the next step is to apply the applicable income tax rate. The current progressive PPh rates are as follows:

| Taxable Income Layer (PKP) | Tax Rate |

|---|---|

| Up to Rp60,000,000 | 5% |

| Above Rp60,000,000 up to Rp250,000,000 | 15% |

| Above Rp250,000,000 up to Rp500,000,000 | 25% |

| Above Rp500,000,000 up to Rp5,000,000,000 | 30% |

| Above Rp5,000,000,000 | 35% |

Example: Referring to the previous example, your PKP is Rp16,000,000. Therefore, the calculation of your payable PPh is:

- PPh = Rp16,000,000 x 5% = Rp800,000

So, your tax payable in one fiscal year is IDR 800,000. This amount is then divided by 12 to determine the monthly installment of Article 25 Income Tax that you need to pay, which is IDR 800,000 / 12 = IDR 66,667 (rounded).

Deductible Expenses for Freelance Income (Business Expenses)

If you choose the actual expense method to calculate your net income, here are some examples of expenses that can typically be deducted from freelance income:

- 6.1. Work Equipment and Supplies: The purchase or depreciation of assets such as laptops, computers, printers, software, desks, chairs, and other office supplies used for freelance work.

- 6.2. Internet and Communication Costs: Monthly internet bills, phone costs, and other communication expenses related to the work.

- 6.3. Marketing and Promotion Costs: Costs for creating a portfolio website, online ads, participation in related exhibitions or events, and other promotional expenses.

- 6.4. Business Travel Expenses: Transportation, accommodation, and meals for trips directly related to freelance projects.

- 6.5. Training and Self-Development Costs: Online courses, workshops, seminars, or books relevant to improving your skills as a freelancer.

- 6.6. Office Space Rent (If Applicable): If you rent a dedicated workspace for freelance activities.

- 6.7. Other Expenses Relevant to Freelance Activities: Membership fees for professional organizations, notary fees, and other costs directly related to your freelance income.

Important to Remember: You must have valid proof of expenses (such as invoices, receipts, or bills) for each cost you deduct.

How to Pay Freelance Taxes

After understanding how to calculate freelance taxes, the next step is to know how to pay and report them. Here’s a practical guide:

7.1. Obtain a Taxpayer Identification Number (NPWP): If you don’t have an NPWP yet, register online through the Directorate General of Taxes website (www.pajak.go.id) or visit the nearest Tax Service Office (KPP). The NPWP is your identity as a taxpayer.

7.2. Register as an Individual Taxpayer Engaged in Business or Freelance Work: When registering for an NPWP or after obtaining one, make sure you are registered as an individual taxpayer running a business or freelance work (in this case, freelance).

7.3. Calculate and Pay Article 25 Income Tax: After calculating your estimated tax payable for the year, you need to pay the Article 25 Income Tax each month before the 15th of the following month. You can make the payment through several methods:

- 7.3.1. Online Payment (e-Billing): This method is very convenient. You can create a billing code through the DJP Online website or tax application service provider (PJAP) apps, then make payments via internet banking, mobile banking, or ATM.

- 7.3.2. Offline Payment: You can also pay taxes directly through designated bank tellers or post offices. You need to bring the correctly filled-out Tax Payment Slip (SSP).

7.4. Report the Annual Income Tax Return (SPT): Every year, you are required to report your Annual Income Tax Return by March 31st of the following year. You can report your SPT online or offline:

- 7.4.1. Online SPT Reporting (e-Filing): This method is more efficient and easy. You can file your SPT online through the DJP Online website. You may need to prepare the Article 21 tax deduction slip (if applicable) and other relevant documents.

- 7.4.2. SPT Reporting Deadline: Remember, the deadline for reporting your Annual Income Tax Return is March 31st every year. Late reporting may result in administrative sanctions.

Consequences for Freelancers Who Do Not Pay Taxes

Neglecting tax obligations as a freelancer can lead to unpleasant consequences, including:

- Administrative Sanctions: Fines for late tax payments or reporting. The amount of the fine varies depending on the type of violation and the duration of the delay.

- Interest: If you are late in paying your taxes, interest will be charged on the unpaid tax amount.

- Criminal Sanctions: In more serious cases, such as intentionally failing to pay taxes or providing false information in tax reporting, criminal sanctions may be imposed according to tax regulations.

- Administrative Difficulties: A poor tax record can cause difficulties in various administrative matters in the future, such as applying for a bank loan or obtaining a visa.

Also Read: How to Report Personal Annual Tax Returns Easily and Quickly

Tips for Effectively Managing Freelance Taxes

Managing freelance taxes may seem complicated, but with proper planning and management, you can minimize potential problems and ensure tax compliance. Here are some tips you can apply:

- 9.1. Keep Organized Financial Records: Regularly record all your income and expenses. This will be very helpful in calculating your net income and preparing your tax reports. Use simple bookkeeping apps or spreadsheets to make the recording process easier.

- 9.2. Set Aside Part of Your Income for Taxes: After receiving payments from clients, immediately set aside a portion of your income for taxes. This will help you avoid a shortage of funds when the tax payment due date arrives.

- 9.3. Take Advantage of Tax Facilities and Incentives: The government often offers various tax facilities and incentives for small and medium-sized enterprises (SMEs), including freelancers. Find out if you qualify for these facilities. For example, the final tax rate of 0.5% for SMEs with annual gross turnover not exceeding IDR 4.8 billion can be an attractive option for some freelancers.

- 9.4. Consult with a Tax Expert if Necessary: If you find it difficult or are unsure about understanding and managing your freelance taxes, don’t hesitate to consult a tax consultant or a public accounting firm. They can provide advice and assistance based on your situation.

Being a freelancer offers a lot of freedom and opportunities, but it also comes with responsibilities, including the obligation to pay taxes. Understanding tax regulations, calculating taxes correctly, and paying and reporting them on time are key to being a professional and responsible freelancer. By managing your taxes well, you not only avoid legal risks but also contribute to the development and progress of Indonesia. So, don’t delay any longer, let’s understand and fulfill your freelance tax obligations!

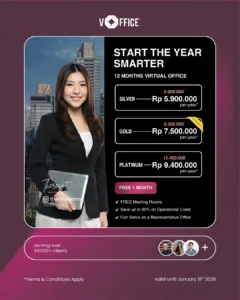

If you need assistance with tax management in Indonesia, you can rely on tax consultancy services from vOffice. Our team can assist you with various tax-related matters, including: