Amending a PPh Article 21 tax return in CoreTax is an official procedure to correct errors in the reporting of Monthly PPh Article 21 Tax Returns through the integrated system of the Directorate General of Taxes (DGT). The amendment process is carried out by creating an amended withholding slip in e-Bupot, then submitting an Amended Monthly Tax Return calculated using the delta SPT mechanism, not by recalculating from scratch. CoreTax DJP, fully implemented since 2025, integrates income data, tax withholding, and payment obligations into a single digital platform. Common errors such as incorrect input of gross income, PPh 21 tax rates, or tax object codes can result in underpayment and interest sanctions if not corrected promptly.

Understanding how to amend PPh Article 21 tax returns in CoreTax is crucial for companies, tax consultants, and freelancers to maintain tax compliance in accordance with Article 8 of the KUP Law and the latest DGT regulations.

What Is an Amendment of a PPh Article 21 Tax Return?

An amendment of a PPh Article 21 tax return is the right of a taxpayer to correct a previously submitted Monthly Tax Return so that it reflects the actual condition. The legal basis is regulated under Article 8 of the KUP Law, as long as the DGT has not conducted a tax audit. In CoreTax, an amendment does not delete the previous tax return (SPT), but instead calculates the difference through the delta SPT mechanism.

Read Also: How to Calculate PPh Article 21: Complete Guide with Examples

When Can an Amendment Be Made?

An amendment can be made at any time as long as there has been no audit notice from the DGT. For Monthly PPh Article 21 tax returns, reporting still follows the general deadline, which is no later than 20 days after the end of the tax period. If the amendment results in an underpayment, the tax payment obligation must be settled before the return is submitted.

Documents You Need to Prepare

Before accessing CoreTax, make sure you have prepared:

- amended withholding slips,

- accurate income data,

- proof of tax payment if there is an underpayment, and

- identity data of the withholder and the income recipient.

Complete documentation will minimize system errors.

Read Also: Unified Monthly PPh Tax Return: Definition and Legal Basis

Steps to Amend PPh Article 21 Tax Returns in CoreTax

Below are the steps to amend a PPh Article 21 tax return in CoreTax:

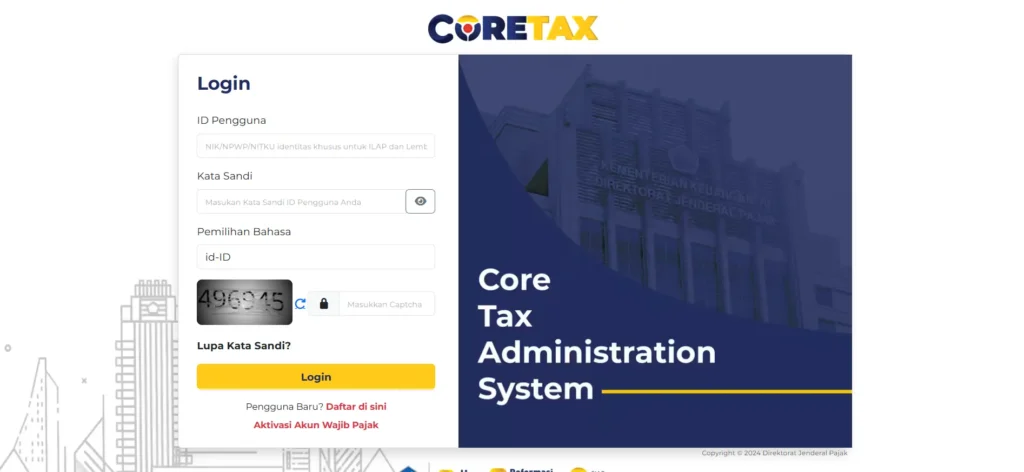

Log in to CoreTax

Log in to CoreTax DJP using your NPWP and password. Once successful, you will see the main dashboard.

Create an Amended Withholding Slip in e-Bupot

Amendments always start in e-Bupot. Select the appropriate type of withholding slip, such as BPA1 for permanent employees. Edit the previous withholding slip, correct the income data, deductions, or identity details, then save it as an amended withholding slip.

Create an Amended Monthly Tax Return

Go to the Tax Return (SPT) menu, select PPh Article 21/26, then set the status as an amendment and enter the amendment sequence number. The system will automatically pull the amended withholding slip data.

Verify Attachments and Calculations

Review all attachments, the number of income recipients, total PPh withheld, and tax object codes. Errors at this stage often cause unexpected tax discrepancies.

Understanding the Delta SPT Mechanism

CoreTax uses the delta SPT mechanism, which calculates the difference between the previous tax return and the amended tax return. If there was previously an overpayment that becomes an underpayment, only the difference needs to be paid. This mechanism prevents recalculation from zero but requires extra accuracy from taxpayers.

Read Also: Differences Between Monthly and Annual Tax Returns: A Taxpayer’s Guide

Handling Underpayments and Overpayments

If the amendment results in an underpayment, you must generate a Billing ID and settle the tax before submitting the tax return. If there is an overpayment, the excess can be compensated to the next tax period in accordance with CoreTax provisions.

Sanctions and Risks of Incorrect Amendments

Amendments that increase tax payable are subject to administrative interest sanctions in accordance with the KUP Law. Other common risks include double compensation or incorrect tax object codes, especially following format changes under PER-11/PJ/2025.

Closing and Solutions for You

Amending a PPh Article 21 tax return in CoreTax requires technical understanding, data accuracy, and up-to-date regulatory knowledge. We understand that for many business owners, consultants, and freelancers, this process can be time-consuming and risky if done incorrectly.

That is why we at vOffice provide accounting and tax return reporting services designed to simplify your entire tax process. With the support of a professional team, you can focus on your business without worrying about errors in PPh Article 21 tax reporting.

vOffice Tax Consulting Services are the right choice to ensure your tax compliance runs safely, efficiently, and in accordance with CoreTax.

Contact us for a FREE consultation!

FAQ on Amending PPh Article 21 Tax Returns in CoreTax

Can a PPh Article 21 tax return be amended more than once?

Yes. You may submit the first, second, and subsequent amendments as long as there has been no tax audit by the DGT.

Is it always necessary to create an amended withholding slip?

Yes. CoreTax requires the amendment process to begin in e-Bupot before the Monthly Tax Return can be amended.

Why does the underpayment amount feel large after an amendment?

This is usually due to the delta SPT mechanism. The difference is calculated based on the previous tax position, not from zero.

Can an overpayment of PPh Article 21 be refunded?

Generally, an overpayment of PPh Article 21 is compensated to the following tax period, not refunded directly.